Introduction to Goldbacks

Goldbacks represent a novel approach to currency, reintroducing the historical principle of using gold as a backing for monetary value. Unlike typical forms of currency, such as paper bills or digital currency, Goldbacks are a unique form of fungible currency. This currency is directly associated with 24-karat gold, providing a tangible sense of value that is rooted in physical assets.

The concept of backing currency with gold is not new. It has been a fundamental principle of monetary systems throughout history. Ancient economies relied heavily on gold, viewing it as a stable medium of exchange and a store of value. With the transition to modern fiat currencies in the 20th century, many nations abandoned the gold standard. This lead to a reliance on government assurances of value rather than a physical commodity. However, as economic uncertainties have increased, the quest for a more reliable form of currency has revived interest in gold-backed solutions.

Goldbacks emerge as a practical solution in this landscape. They answer the growing desire for a currency with less volatility and inherent worth. Individuals and businesses looking for alternatives to traditional cash flow can utilize Goldbacks. They can enjoy both the benefits of a conventional currency and the security that comes with gold backing. Amidst fluctuating economic conditions, this opens new avenues for transactions in marketplaces where people are seeking to preserve value .

As we delve deeper into the Goldback, it is essential to explore where and how to use them effectively. This will aid individuals in understanding their practical aspects and advantages in today’s financial ecosystem.

The Composition of Goldbacks

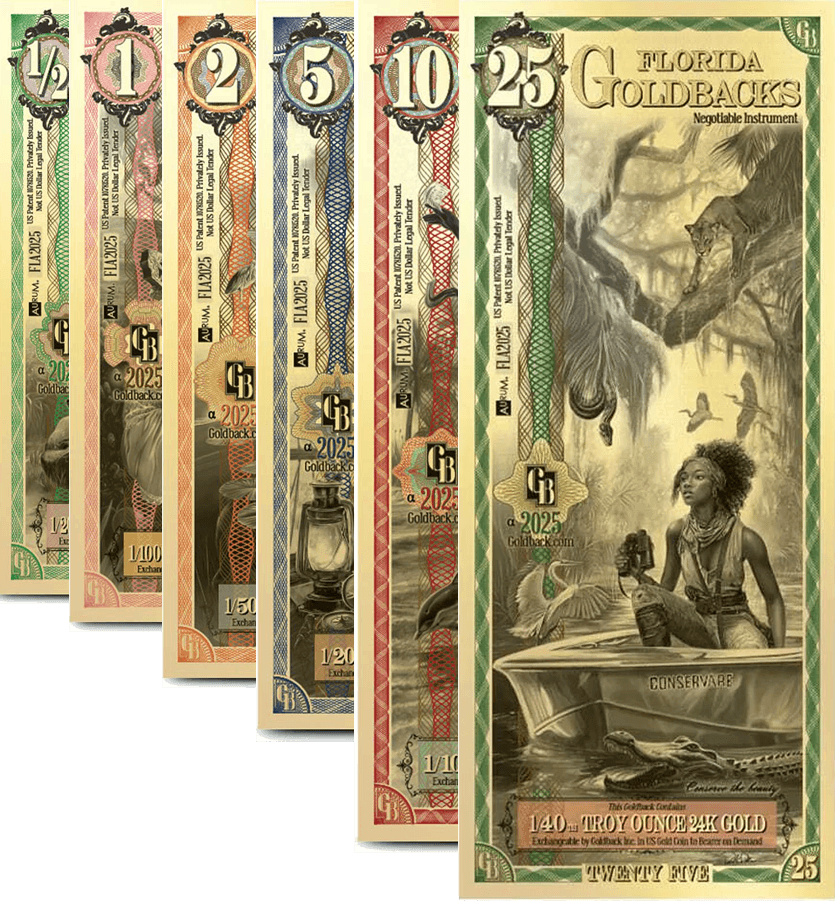

Goldbacks represent an innovative approach to currency, rooted in the fundamental value of 24 karat gold. Unlike traditional fiat currencies, Goldbacks are designed to provide a tangible asset. A medium of exchange and a store of value. Each Goldback is made incorporating a specific amount of 24 karat gold as part of its design. This unique feature ensures that the value of Goldbacks is intrinsically linked to the fluctuating price of gold.

Goldbacks are intrinsically linked to the value of 24 Karat Gold

Each denomination of Goldbacks contains a precise weight of gold; for example, a one Goldback note typically contains one one-thousandth of an ounce of gold. This ensures that users can easily understand and determine the value of their currency in relation to gold prices. The physical features of Goldbacks include intricate designs that not only highlight their gold content but also incorporate advanced security measures to combat counterfeiting. As a result, they have a tactile quality and aesthetic appeal that differentiates them from standard paper bills.

Furthermore, these notes are produced using high-quality materials, which enhance their durability and longevity compared to traditional currency. The colored layers on the Goldbacks contain the embedded gold, offering a visual representation of the gold backing. These elements make Goldbacks more than just a means of exchanging value; they are collectibles that are visually appealing and can evoke a sense of trust and confidence among users. Overall, the golden hue and craftsmanship of Goldbacks set them apart, making them an attractive alternative for individuals seeking a reliable form of currency that carries inherent value.

The History of Gold-Backed Currencies

The concept of gold-backed currencies dates back to ancient civilizations, where the intrinsic value of gold made it a trusted medium of exchange. As early as 3000 B.C., the Egyptians and Mesopotamians recognized gold as a valuable asset, using it in trade and as a symbol of wealth. This reliance on gold paved the way for more structured forms of currency. With the establishment of coinage in around 600 B.C. by the Lydians, gold became standardized in weight and purity, setting the foundation for future monetary systems.

Circa 564-539 B.C. on behalf of King Kroisos of Lydia, the ancient Greek coin is the first gold coin known to be made by man.

Throughout history, various empires and nations have adopted gold as a benchmark for their currency systems. The Roman Empire utilized gold coins, known as aureus, which facilitated trade and commerce across vast territories. The significance of gold became even more pronounced during the Middle Ages, with the establishment of the gold standard, which linked currency value directly to a specific amount of gold. This method provided stability in trade but also made economies vulnerable to changes in gold supply.

As modern economies progressed, the gold standard reached its peak in the 19th century, leading to greater international trade. However, with the onset of World War I and subsequent economic turmoil, many countries abandoned the gold standard in favor of fiat currencies. This transition resulted in a more flexible monetary policy but ignited concerns about inflation and currency devaluation.

In recent years, there has been a revival of interest in gold-backed systems, driven by increasing economic uncertainty and inflation. Today’s goldbacks represent an innovative approach, allowing individuals to hold and use currency backed by physical gold, contributing to a more stable financial system. As consumers become increasingly aware of the benefits and methods of utilizing goldbacks, questions about where to use goldback currency and how to use goldbacks effectively arise, marking a potential shift in the way currencies are perceived and utilized in the modern economy.

How Goldbacks Work

Goldbacks are a unique currency that offer a new approach to transactions by integrating 24 karat gold into their structure. The fundamental premise of Goldbacks is that each note is backed by actual gold, giving each denomination intrinsic value derived from the quantity of gold it contains. For instance, a Goldback note might represent a specific amount, such as 1/1000th of an ounce of gold, allowing users to understand the approximate value in real-time, making it easier to assess the worth of their holdings or barter in transactions.

Why Use Goldbacks?

While other currencies depreciate, Goldbacks maintain their value, resisting inflation and giving you more purchasing power.

Write your state representatives and encourage them to learn about the Goldback and its benefits. Tell your friends and neighbors of the investment opportunity.

When individuals consider where to use Goldbacks, they will find that these currency notes can be utilized in various settings, including local businesses and online transactions. This functionality supports the adoption of fungible currency, where Goldbacks can be exchanged with ease, facilitating trade and commerce. Users can easily incorporate Goldbacks into their daily lives by exchanging them for goods and services, much like traditional paper currency. However, the added layer of gold backing provides a hedge against inflation, as the value of the notes is directly tied to the price of gold, which historically maintains its worth over time.

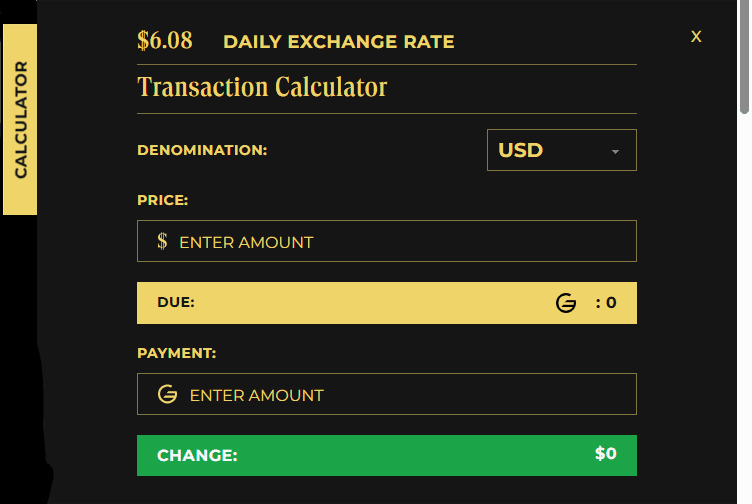

In terms of transaction mechanics, using Goldbacks involves a straightforward process. Users can present notes at points of sale, where merchants can either accept them directly or exchange them for goods. The ease with which one can use Goldbacks is enhanced by technological advancements, such as mobile applications and digital wallets, which allow for fast and secure transactions. Some businesses may even leverage sophisticated point-of-sale systems that can integrate price data for gold, making it simple to determine the current exchange rate for everyday purchases. Ultimately, Goldbacks represent a modern solution for those seeking to engage with a reliable currency that is both practical for daily transactions and significant for maintaining value over time.

An online exchange calculator is available for merchants and traders as well as a phone app for IOS and Android

Advantages of Using Goldbacks

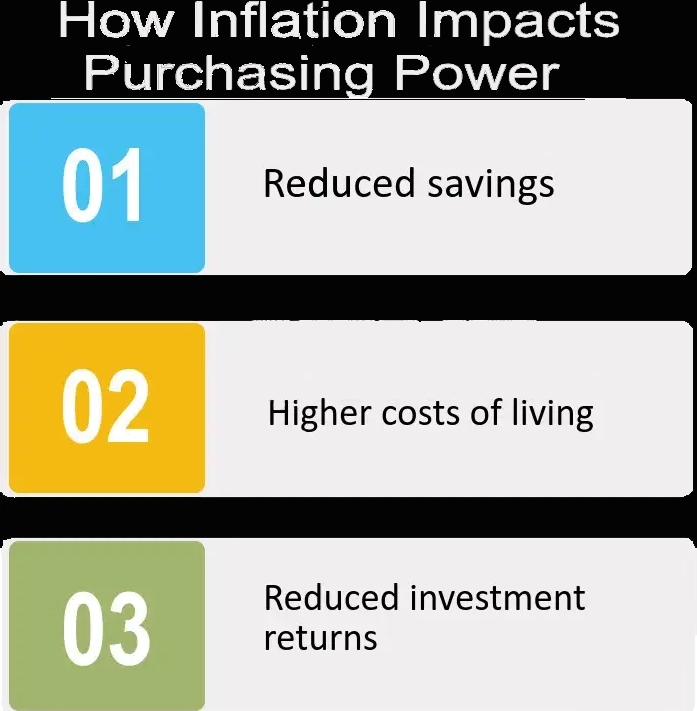

The emergence of Goldbacks as a form of currency introduces several advantages when compared to traditional fiat currencies. One of the most significant benefits is the inherent stability that gold provides. Different from fiat currencies, which are subject to inflationary pressures, Goldbacks are backed by 24 Karat gold, giving them a stable value. This mechanism offers protection against inflation, enabling individuals to maintain their purchasing power over time. Given the historical context of gold’s value retention, it becomes clear why many are considering how to use Goldbacks as a hedge against economic uncertainty.

Furthermore, Goldbacks serve as a decentralized currency, removing the influence of central banks and government policies on its value. In contrast to traditional currencies that can be manipulated through monetary policies, Goldbacks operate independently. This decentralization appeals to those seeking autonomy over their finances, encouraging more individuals to explore where to use Goldbacks in everyday transactions.

Inflation impacts consumer purchasing power negatively. Goldbacks are completely legal. They combine the principles of local currencies—which have existed in the United States for centuries—with the enduring value of gold.

The appeal of Goldbacks extends beyond just stability and independence. This currency symbolizes a return to tangible assets, allowing users to directly connect their wealth to a physical commodity. By leveraging the intrinsic value of gold, Goldbacks offer a unique solution to those disillusioned with the volatility of modern investment landscapes. Investing in Goldbacks can foster a greater sense of security that is often absent in conventional fiat systems.

In conclusion, the various advantages associated with Goldbacks, stability, inflation protection, intrinsic value, and decentralized natur make them an attractive alternative to traditional forms of currency. As more people become aware of how to use Goldbacks effectively, it is likely that their popularity will continue to grow.

The Future

As we venture into an era of digital transactions and evolving currencies, the future of Goldbacks appears promising. One potential factor contributing to their growth is the rising consumer interest in alternative forms of currency. Traditional fiat currencies can be subject to inflation and devaluation. Gold-backed currencies provide a sense of stability due to the intrinsic worth of gold. This attraction could lead more consumers to seek out where to use Goldbacks in their everyday transactions.

Market trends also indicate a shift towards a more diversified approach to currency. As people become more aware of financial alternatives, the demand for how to use Goldbacks could spur wider adoption. Moreover, as global economies fluctuate, individuals and businesses may turn to gold-backed currencies as a hedge against economic uncertainty. Such market dynamics may encourage merchants to accept Goldbacks, creating a more robust ecosystem for this innovative currency.

Technological advancements play a crucial role in facilitating the growth of gold-based currency systems. The integration of blockchain technology can enhance the efficiency and security of transactions using Goldbacks. Additionally, mobile payment platforms that support gold-backed currencies could simplify the purchasing process. This makes it easier for consumers to transact with Goldbacks. As innovation continues, it is likely that we will see an increase in platforms designed to promote their use.

In conclusion, the future of Goldbacks seems optimistic, driven by consumer interest, market trends, and technological innovation. We may witness a significant shift towards the broader acceptance of gold-backed currencies, reshaping the landscape of fungible currency options.

Fungibility

Wikipedia

In economics and law, fungibility is the property of a good or a commodity whose individual units are essentially interchangeable. In legal terms, this affects how legal rights apply to such items. Fungible things can be substituted for each other; for example, a $100 bill is considered entirely equivalent to twenty $5 bills, and therefore a person who borrows $100 in the form of a $100 bill can repay the money with twenty $5 bills. There is no requirement to return the same $100 bill. Non-fungible items are not substitutable in the same manner.

in Conclusion

Representative of a significant innovation in the field of currency, they are backed by physical 24-karat gold. They provide a tangible asset that contrasts sharply with traditional fiat currencies. This unique characteristic positions Goldbacks as a stable financial instrument amidst the volatility in the global economy. Understanding where to use Goldbacks can offer individuals and businesses a means to hedge against inflation and economic uncertainty.

Goldbacks Advanced Security Features:

- The intricate design elements on the front include government-level security measures. UV-reactive ink is embedded in all Goldbacks year 2025 and forward.

- Negative Image: The reverse side has a visible and tactile negative image.

- Authentic Gold Appearance: The glisten of real gold is impossible to replicate, and no one else has mastered this specific vacuum deposition process.

One of the most compelling features of Goldbacks is their fungibility. They can be used in transactions just like traditional cash, but with the added assurance of underlying value. This process of using Goldbacks can be relatively straightforward. Individuals can purchase goods and services with them, thus promoting an economy that values gold as a medium of exchange. Moreover, as the potential for their acceptance in various sectors increase this leads to wider adoption.

Considering the viability of Goldbacks, it is clear that they offer a combination of stability and modern convenience. Their potential to act as a hedge against inflation and to provide a reliable, intrinsic value makes them particularly appealing. The continued exploration of their practical applications will be crucial in determining their role in the evolving world of currency. Thus, Goldbacks not only represent a new era of currency backed by gold. This also symbolizes a movement towards grounded financial alternatives that could resonate with consumers and investors alike.

How to spend Goldbacks online?

A video Describing the Florida goldback – 9 min 35 sec

That’s a good question. Short of sending them to the merchant and waiting, is there a better method?

Alpine Gold has introduced an innovative leasing program designed to enhance the value and utility of your precious metal investments. This new program enables participants to earn a steady return on their goldback or various other precious metal portfolios. It also provides a practical financial tool in the form of a debit card. Your debit card is directly linked to your metal holdings. It gives you the flexibility to conveniently access and spend the value stored in your precious metal portfolio. Furthermore, the program emphasizes the security and growth potential of your investments. And seamlessly integrates the benefits of traditional banking services with the inherent value of your metal assets. With Alpine Gold’s new initiative, investors can enjoy increased financial freedom while capitalizing on the worth of precious metals.