Coin collectors often face a quiet tension as the thrill of the hunt collides with financial concerns, authenticity doubts, valuation uncertainty, and of course, swings in the market. When those pressures hit, money mindset biases and other cognitive biases in finance can steer decisions toward impulsive buys, hesitant selling, or chasing hype, creating real financial success challenges. A gentle financial mindset transformation helps collectors notice the story money is telling in the background and choose a steadier numismatic investment mindset. With more clarity and calm, each purchase and pass becomes easier to trust.

Understanding Money Mindset Pitfalls in Real Time

At its core, this concept is learning to spot your mental shortcuts while you are making money decisions. When you can name patterns like immediate gratification, overconfidence, loss aversion, and recency bias, you stop treating them as “truth” and start treating them as signals. The pull toward quick rewards is one common signal that your brain wants relief, not a wiser deal.

This matters because coin buying and selling is full of emotion, uncertainty, and fast-moving chatter. Recognizing your bias early helps you pause, double-check a valuation, and lean on reliable appraisal and diverse numismatic resources. That protects your budget and reduces regret.

Picture a coin trending after a big auction result. Recency bias says “prices only go up,” while loss aversion says “don’t sell, you’ll miss out.” Label the feeling, then confirm comps and authenticity before you act.

Understanding a Money Mindset That Sticks

These tools are about rebuilding trust with yourself around money. You learn to forgive past missteps, notice what you feel before you buy, and replace old stories like “I always mess this up” with calmer, truer ones. Simple self-awareness practices like writing down everything you spend turn vague guilt into clear information you can use.

It matters because collecting rewards consistency more than perfect timing. When emotions are steadier, you can pay for a reliable appraisal, compare references, and choose diverse numismatic resources without panic spending. Over time, habits like 25% have money from their paycheck directly deposited into their savings account show how small systems reduce decision fatigue.

Imagine you overpay on a coin and feel embarrassed. Instead of revenge-buying to “make it back,” you log the lesson, set a cooling-off rule, and plan one focused purchase after checking comps. The mistake becomes tuition, not a label.

Use a 10-Minute Plan to Earn More and Save Faster

- Run a “10-minute money scan” before you buy coins: Open your accounts and do three quick checks: current balance, upcoming bills in the next 7 days, and how much is left for discretionary spending. This works because it replaces impulse with awareness, the same self-awareness skill you’re building for lasting habits. If you’re heading to a coin show, set a hard “cash-only” limit based on that scan so your collecting stays joyful, not stressful.

- Create two simple buckets: Life First, Collecting Second: Choose a fixed weekly amount for essentials (food, fuel, bills) and a separate “coin fund” amount, even if it’s small. When you separate the buckets, you stop negotiating with yourself every time you see a tempting new slab or raw lot. If money is tight, start with a 90/10 split and adjust monthly; consistency is more important than a perfect ratio.

- Set one clear goal with a date and a number: Pick a goal that reduces stress and frees future cash flow, like building a $500 buffer or paying down high-interest debt. A concrete example like Pay off $5,000 of credit card debt shows how a specific amount and timeline turns “someday” into a plan. Write your goal on a card near your collection area so every purchase decision gets checked against it.

- Cut one “silent expense” and redirect it to your coin fund: Look for subscriptions, fees, and convenience spending you barely notice, then cancel or downgrade just one today. Redirect the exact amount into a separate savings pocket labeled “Supplies + Slabs + Shows” so the savings doesn’t disappear. This technique works because it reduces decision fatigue: the money moves automatically, and you don’t have to rely on willpower.

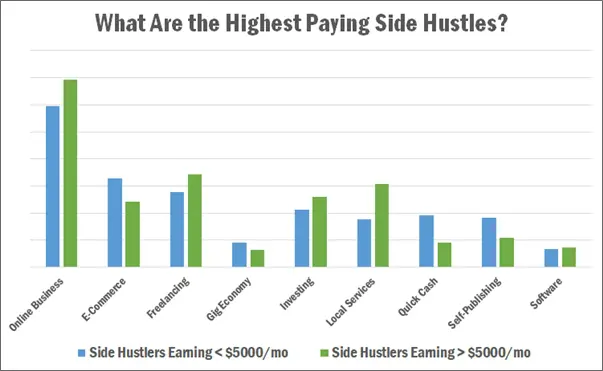

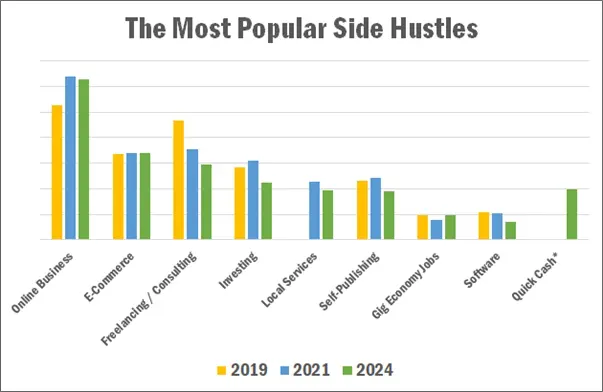

- Add a side-income stream tied to your numismatic skills: Use what you already know: photograph and list duplicates, offer basic inventory organizing for other collectors, or help someone prep for an estate sale with careful sorting (no appraisals unless qualified). If you prefer non-coin work, you’re not alone, 39% of working Americans report having a side hustle, so small, flexible gigs are common. Keep it simple: one hour twice a week, and track profit separately from your collecting budget.

- Practice “smart investment basics” to protect your collecting goals: If you have an emergency fund and manageable debt, consider automating small, regular contributions into diversified, low-cost investments rather than trying to “pick winners.” Diversification can reduce the chance that one bad month forces you to sell coins quickly or skip essentials. Think of it as storage for future options, your collection thrives when your core finances feel stable.

Small daily actions build trust with yourself, and that trust makes it easier to choose one financial challenge to tackle first and one skill that can grow your income over time.

Money Mindset Q&A for Collectors

Q: How can I identify and overcome biases that cause me to prioritize short-term spending over long-term financial goals?

A: Start by naming your “hot moments,” like auctions, shows, or late-night browsing, then note what you were feeling right before spending. Use a 24-hour pause rule for anything above a set amount and keep a simple wish list so desire does not become impulse. The goal is to build financial empowerment by choosing on purpose, not perfectly.

Q: What are effective strategies for letting go of past financial mistakes and the emotions tied to them?

A: Reframe the mistake as tuition: write what it taught you and the one boundary it creates today. Try a brief “reset script” before purchases, such as “I can enjoy coins and still protect my future.” If shame sticks, talk it out with a trusted person or counselor so the emotion stops driving decisions.

Q: How can practicing good money habits help reduce financial stress and feelings of overwhelm?

A: Small routines lower uncertainty, and uncertainty is what often fuels stress. Pick one repeatable habit, like a weekly bill check or automatic savings, and let it run even when motivation dips. Over time, consistency builds the confidence that you can handle surprises.

Q: What practical steps can I take to start saving more money without feeling deprived?

A: Save first, but start tiny: a fixed amount you will not notice, then increase it after two weeks. Keep “collecting joy” by budgeting for one planned buy, while redirecting the rest to a buffer or debt payoff. Make it visible with a separate savings label for your coin goals so progress feels real.

Q: What options are available if I feel stuck financially and want to quickly gain new skills to increase my earning potential?

A: First, identify your biggest constraint: low income, high expenses, or unstable cash flow. Next, choose one income-growth skill you can practice weekly, like customer support, spreadsheet basics, sales, or a trade skill. If you want a faster, structured path, an accelerated program that stacks credentials, such as a computer science track that can lead into a bachelor of science and onward to a master’s, can be a practical fit for higher-earning roles.

Build a Steadier Money Mindset to Fund Your Collection

It’s easy for coin collectors to feel pulled between enjoying the hunt and worrying about budgets, bills, and whether goals are slipping away. The path forward is a calm, repeatable approach: ongoing money mindset practice that links spending choices to values, skill-building, and clear priorities. With time, mindset shift results show up as sustained financial motivation, steadier buying decisions, and more positive financial outcomes, often mirroring the personal finance success stories where small changes compound into real momentum toward achieving financial goals. One small money move, repeated daily, can change your collecting future. Choose one money move today, track it, then repeat it tomorrow. That consistency builds resilience and stability that supports both life and the collection.

Article submitted by Mary Green