Introduction to the United States Mint

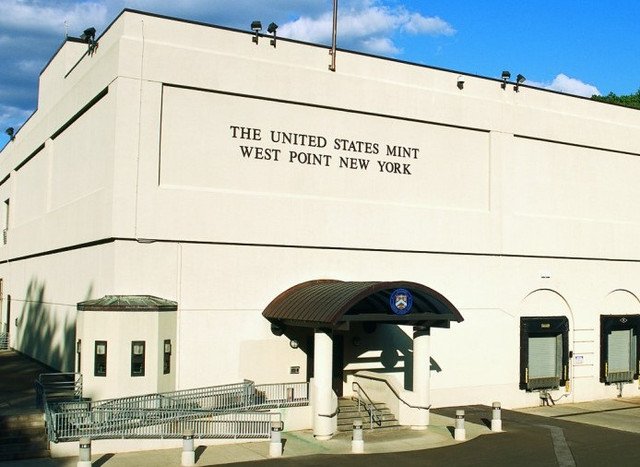

The United States Mint, established in 1792, plays a vital role in the history of American currency. Tasked with the production of coinage for the nation, the Mint has evolved significantly over the years, reflecting the changing economic landscape and monetary policies of the United States. Initially, the primary goal of the Mint was to create a standardized currency that would facilitate commerce and provide financial stability during the early years of the Republic.

The Mint was created in response to the need for reliable currency, particularly in the wake of various state-issued currencies that often led to confusion and distrust among consumers. By establishing a national mint, the government sought to ensure the reliability and uniformity of coinage, which in turn supported commerce and investment across the expanding nation. Throughout the years, the Mint has produced various forms of currency, including gold coins, silver coins, and paper notes, thereby adapting to the changing demands of the economy.

Historically, the Mint has been especially crucial during periods of gold discovery and rush, particularly during the California Gold Rush of 1849. The influx of gold resulted in substantial economic growth and necessitated the Mint’s expansion and adaptability in minting gold coins to integrate into circulation seamlessly. The production of gold pieces, such as the iconic double eagle and the Indian Head gold pieces, not only provided the population with a trusted currency but also contributed to the broader national economy. As the Mint continues to evolve, it remains a cornerstone of the American financial system, reflecting the rich history and ongoing changes within the nation’s economic framework.

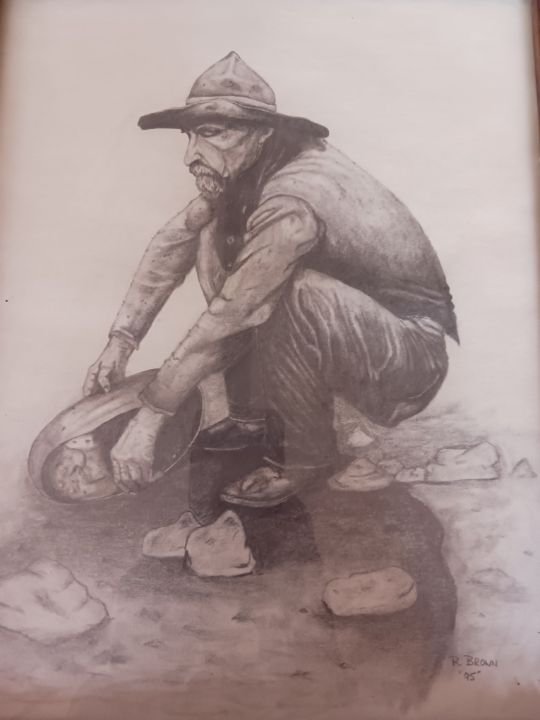

Prospectors faced backbreaking labor under the scorching California sun, as they sifted through riverbeds and excavated earth in search of the elusive gold. The primitive techniques of the time, such as panning and placer mining, required not only physical endurance but also a keen eye to spot the glimmer of fortune amid the silt.

The Birth of Gold Coinage

The inception of gold coinage in the United States is closely linked to the historic California Gold Rush that began in 1848. This pivotal event led to a surge in gold discovery, subsequently prompting the U.S. government to produce its first official gold coins in 1849. Prior to this period, the currency system was primarily dominated by silver and foreign coins, as a standardized gold coinage did not exist. The establishment of gold coins marked a significant transition in American monetary policy, addressing the rising demand for gold in both trade and personal wealth.

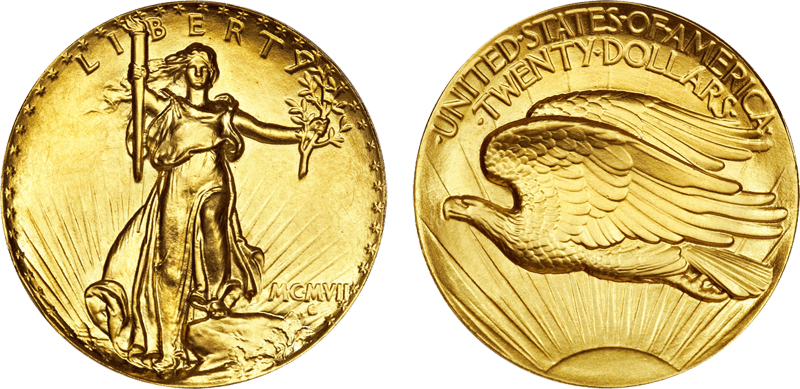

The introduction of gold coins served multiple purposes, including stabilizing the economy, facilitating trade, and creating a more uniform currency system. The initial mintage featured several denominations, including the well-recognized $1, $2.50 (quarter eagle), $5 (half eagle), $10 (eagle), and $20 (Double Eagle). Each of these coins not only reflected the prevailing gold standard but also played a crucial role in fostering economic growth during a transformative era in American history. The $20 Double Eagle, for example, became one of the most popular gold coins, valued for both its weight in precious metal and its use in large transactions.

1849 Double Eagle $20 Gold. The 1849 is essentially a pattern coin and outside of rumors no more than possibly two were made in proof quality. One exists for sure today in the Smithsonian Institute. Designed by Saint Gaudens, it is the most famous and written about coin in United States Mint history.

Gold Rush Era: Impact on Currency and Society

The Gold Rush Era, particularly marked by the California Gold Rush of 1849, had profound implications for both currency and society in the United States. As thousands of prospectors migrated westward in hopes of striking it rich, there was an unprecedented surge in population in previously sparsely populated areas. Cities like San Francisco transformed from quiet settlements into bustling urban centers almost overnight, as hopeful miners and entrepreneurs flocked to the goldfields. This migration was not just limited to California; various gold rushes in states like Colorado, Nevada, and Alaska followed, further influencing the demographic landscape of the nation.

The influx of migrants necessitated the establishment of mining towns, which often sprang up near gold discovery sites. These towns played a crucial role in transforming transient populations into settled communities. The rapid growth of these towns caused social shifts, as diverse groups brought different cultures, lifestyles, and expectations. This often led to a chaotic environment where lawlessness prevailed, prompting the establishment of local governance and order, which would eventually contribute to the development of civic institutions.

The Gold Rush Era created a need for assayers, refineries and coin makers to fill the rush of gold coming into play in the economy. This need was filled by private and quasi-government concerns. Many were dishonest about the quality of their coins and created anger among the public. California gold pieces are quite rare today as most were melted down to make government coinage.

As mining operations expanded, the need for a reliable currency became increasingly evident. Gold coins and pieces emerged as the standard medium of exchange, allowing for transactions among miners, merchants, and service providers. The widespread acceptance of gold as currency fostered economic stability in these burgeoning communities, facilitating trade and commerce. Moreover, the minting of gold coins by the United States Mint, such as the iconic Liberty Head and St. Gaudens pieces, solidified gold’s role in the economy. These coins became integral not only in business transactions but also as symbols of wealth and aspirational societal status during this transformative period in American history.

Evolution of Gold Coin Designs

Throughout history, the designs of gold coins produced by the United States Mint have reflected the cultural, political, and artistic movements of their respective eras. One of the earliest and most iconic designs is the Liberty Head, which first appeared in the mid-19th century. Struck from 1849 until 1907, the Liberty Head gold coins were characterized by the depiction of Lady Liberty adorned with a classic phrygian cap, symbolizing freedom and the pursuit of happiness. This design, created by engraver James B. Longacre, not only established a national identity at a time of burgeoning coinage but also represented the growing optimism of a young nation.

In tandem with the Gold Rush era, the Mint introduced the Saint-Gaudens Double Eagle in 1907. This design, crafted by the renowned sculptor Augustus Saint-Gaudens, redefined American coinage through its exquisite artistry. The obverse features a powerful depiction of Lady Liberty striding forward, while the reverse showcases a majestic eagle in flight. This coin was so celebrated for its aesthetics that Theodore Roosevelt famously sought to invigorate American artistry in coinage, resulting in a transformation that set a high standard for future designs. The Saint-Gaudens Double Eagle remains one of the most sought-after gold coins among collectors, a testament to its enduring legacy.

Heralded as the most beautiful coin the United States has ever produced, the Saint-Gaudens double eagle is a coin treasured by numismatists, valued by investors, and loved by just about anyone who manages to get their hands on one.

Fast forward to the 1980s, the American Gold Eagle was introduced as part of the U.S. Mint’s bullion coin program. This design draws inspiration from previous iconic pieces, incorporating the same themes of liberty and strength. The obverse image of Lady Liberty holding a torch and olive branch is reminiscent of the earlier designs, while the reverse features a family of eagles, symbolizing unity and resilience. The American Gold Eagle continues to be a cornerstone of the gold bullion market, representing both investment and artistry, reflecting the ongoing evolution of gold coin designs in American history.

Minting Techniques and Innovations

Throughout the history of the United States Mint, the evolution of minting techniques and technologies has significantly influenced the production of gold coins. In the early days of coinage, the process primarily involved manual labor, where skilled artisans crafted coins by hand striking gold blanks with engraved dies. This labor-intensive method posed limitations in terms of efficiency and consistency in coin quality.

As demand for gold coins increased, particularly during the Gold Rush era, the Mint began to adopt more sophisticated techniques. The introduction of steam-powered machinery in the 19th century revolutionized the minting process. This technological innovation allowed for the mass production of coins, greatly enhancing efficiency. Machines could produce a higher volume of coins in a shorter time frame, leading to a significant reduction in labor costs.

Furthermore, advancements in die-making technology improved not only the speed of production but also the precision of the coin designs. The use of more durable materials for dies, such as hardened steel, resulted in better-quality impressions and longer-lasting production tools. The U.S. Mint also experimented with various minting techniques, including the use of coining presses that applied greater pressure and enabled the creation of more detailed designs on coins.

In the 20th century, innovations such as automatic feed systems and electronic controls further modernized the minting process. These advancements helped the Mint respond to the increasing demand for gold coins, particularly during economic fluctuations and periods of inflation. By continuously refining minting techniques and incorporating new technologies, the United States Mint was able to maintain high standards of quality and efficiency in gold coin production, reflecting the dynamic nature of the nation’s economic history.

Challenges Faced by the Mint: Economic and Legislative Changes

The United States Mint has encountered numerous challenges throughout its history, particularly related to economic conditions and legislative changes that have significantly impacted gold coinage. One of the most pronounced challenges has been economic downturns, such as the Panic of 1837, which led to a severe recession and a sharp decline in the availability of gold. This economic turmoil forced the Mint to adapt its operations and procedures to maintain stability in gold production and ensure the integrity of gold coins within the marketplace.

Alongside economic challenges, shifts in gold availability have also posed significant challenges to the Mint. The Gold Rush era, marked by the discovery of gold in California in 1848, brought an unprecedented influx of gold to the Mint. However, fluctuations in gold deposits due to mining successes and failures in various regions created inconsistent supplies. In response, the Mint employed various strategies to manage these fluctuations, including adjusting production schedules and adopting new technologies aimed at enhancing operational efficiency.

Legislative changes have further influenced the Mint’s response to external pressures. The Coinage Act of 1965, for instance, transformed the gold coinage landscape by restricting the issuance of gold coins and leading to the cessation of gold certificates. These legislative shifts compelled the Mint to innovate and diversify its product offerings, focusing more on collectible coins and bullion products that catered to the evolving demands of the public and investors. Throughout these turbulent times, the Mint remained committed to its dual mission of ensuring the supply of coinage and maintaining the quality and integrity of gold pieces, navigating economic complexities and adapting to legislative requirements effectively.

The Decline of Gold Coin Use: Transition to Fiat Currency

The transition from gold coins to fiat currency in the United States was a significant turning point in the history of money, impacting the operations of the U.S. Mint and the financial landscape at large. Initially, gold coins were a primary medium of exchange, primarily due to their intrinsic value and the widespread public trust in their worth. However, as the economy began to expand and the needs of commerce evolved, the limitations of gold coinage became apparent.

The Gold Standard, established in the 19th century, initially solidified gold’s role as a basis for monetary value. Under this system, the value of currency was directly tied to a specific quantity of gold, which provided a measure of stability and confidence in paper money. Nevertheless, as the demands of a growing economy and the complexities of trade increased, the rigidity of the Gold Standard began to show its drawbacks. The necessity for a more flexible monetary system prompted discussions about the merits of transitioning to fiat currency, which is not backed by a physical commodity but derives its value from the government’s declaration.

This shift marked a pivotal juncture for the U.S. Mint. With the introduction of Federal Reserve notes in the early 20th century, gold coins became less pivotal in daily transactions. The Mint adapted by altering its production focus, increasingly emphasizing paper currency and other coin forms rather than gold pieces. This transition facilitated more efficient monetary policies and allowed the government to respond swiftly to economic challenges. Over time, as the public grew accustomed to fiat currency, confidence in gold as a primary medium of exchange dwindled, culminating in the full abandonment of the Gold Standard in 1971.

The decline of gold coin use heralded significant changes, shifting the national monetary policy and redefining financial transactions for future generations. This transition continues to influence the dynamics of the economy and the operations of the U.S. Mint today.

Collecting Gold Coins: A Historical and Financial Perspective

Collecting gold coins has long been a pursuit filled with both passion and investment potential. Historically, gold coins served not only as currency but also as a symbol of wealth, craftsmanship, and artistry. The early gold pieces minted in the United States reflected the nation’s evolving economy and the significance of gold during periods such as the Gold Rush. Today, these coins captivate collectors and investors alike, as they offer a tangible connection to history while possessing intrinsic value.

The appeal of gold coin collecting spans multiple motivations. For many enthusiasts, the historical significance of specific coins adds an enriching layer to their collection. Rare coins from prominent eras, such as the California Gold Rush, are sought after for their unique designs and the stories they tell about the times in which they were produced. The historical context adds depth to the collection, making each piece a part of a larger narrative regarding American wealth and development.

From a financial perspective, gold coins represent a stable investment option. The market for gold coins has demonstrated resilience, often appreciating in value over time, particularly during economic downturns when other assets may falter. Investors are drawn to the bullion value of gold coins, which fluctuates based on market prices for gold. Additionally, certain collectible coins, which may be rarer in mint condition, can experience higher price appreciation, providing both aesthetic enjoyment and financial gain.

Furthermore, the desire for a hedge against inflation and currency devaluation propels many into the world of gold coin collecting. The tangible nature of gold coins provides collectors with a sense of security, as they can physically hold their investment. Additionally, the inviting community of collectors, sharing insights and knowledge at conventions and online platforms, fosters a rich environment for both novice and seasoned investors.

Conclusion: The Legacy of Gold in American Currency

The historical significance of gold pieces within the context of the United States Mint extends far beyond mere currency. The introduction of gold coins transformed the American monetary system, facilitating trade and laying groundwork for a more robust economy. Gold served not only as a stable medium of exchange but also emerged as a symbol of wealth and prosperity during pivotal moments in American history, including the Gold Rush eras. As prospectors flocked to the West in search of fortune, the influx of gold played a critical role in shaping the nation’s economic landscape.

The Gold Rush catalyzed an unprecedented influx of resources, driving innovations in mining technologies and directly contributing to the expansion of infrastructure. Cumulatively, these developments not only enriched individual miners but also increased the nation’s gold reserves, allowing for the minting of gold pieces that would become integral to commerce. The establishment of the United States Mint in 1792 marked a definitive shift towards a standardized currency system, wherein gold coins signified trust and stability, facilitating national growth.